What To Do With Your Tax Refund: Don't Just Get Back, Get Ahead!

For some, tax season can be the most wonderful time of the year, but for others (like myself) it can be the most interesting time of the year. Between your credits and itemized things - your refund can either re-up or restructure your stacks. While I’m no tax person or CPA, I can tell you how to CYA (Cover Your Accounts) your refunds that you may get - big or small. You’ve seen the posts and stories of how folks get their return and can’t figure out the Return of It (another ROI). They blow it and are still trying to figure out how to show it months later.

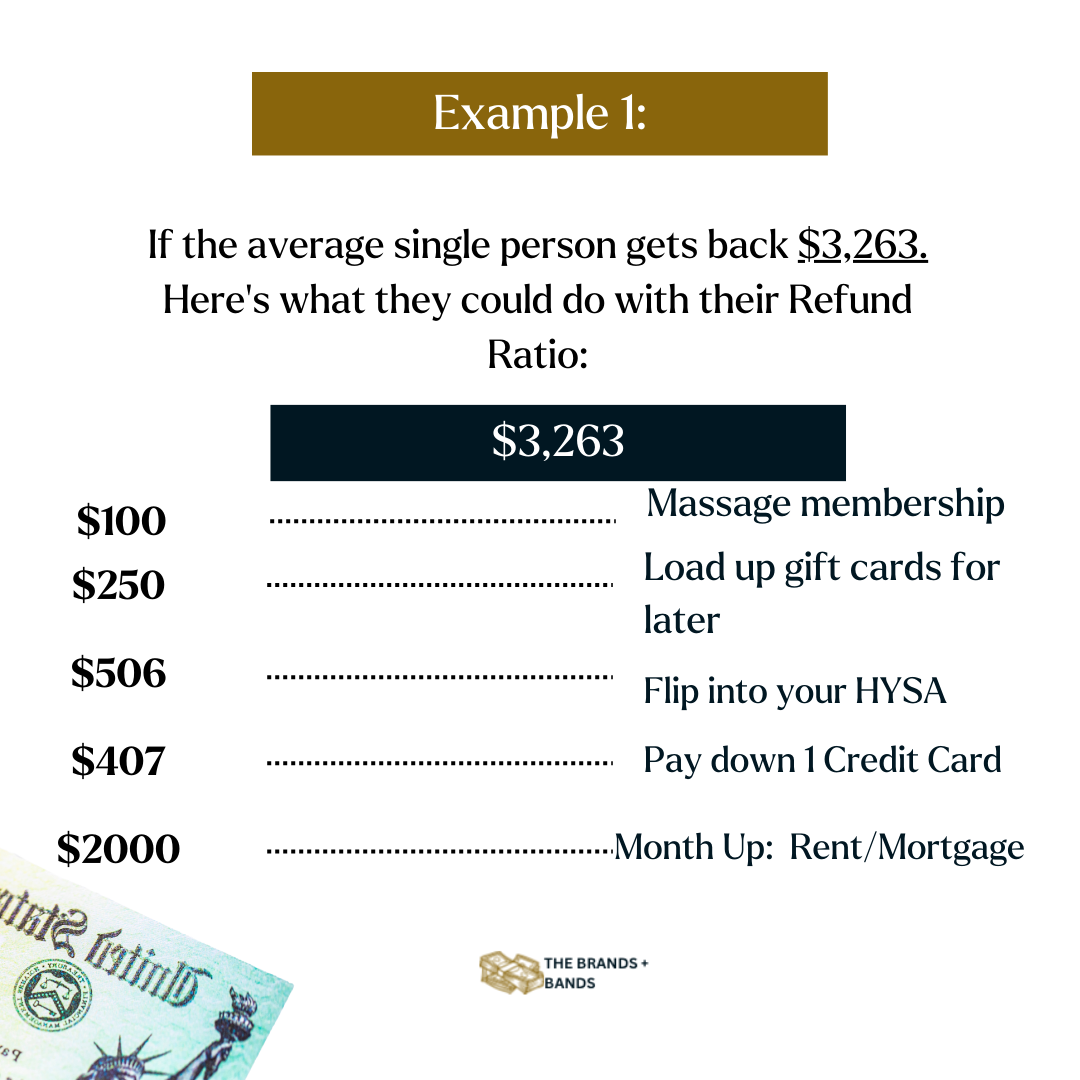

In this post, I want to introduce a theory when it comes to what to do when you get your tax return. The average tax return for the 2023 tax year, filed in 2023, was $2,903. This is a decrease of 11% from the average refund of $3,263 in 2022. Even if you get roughly $2,903, more or less - I want to show you how to make that return re-up and restructure to be seen not only throughout this year but the years to come.

So instead of you blowing your advance or refund, I want to show you how to build beyond that usual 5 -8 week window that people usually have their refund in their bank account. I don’t want your money fumbled and gone, I want you to be funded for at least a couple of months.

If you’re into budgeting, you’ve probably heard about ratios. Budget ratios allow you to fully understand how much of your budget should be grouped into this expense area. Sometimes the ratios don’t fit your reality of how your paycheck, bills, and life add up. Flip this idea to your tax return or advance, I want to introduce knowing your Refund Ratio. This is looking at how much of your refund is going toward this specific thing/ goal.

As you know about the ratio of 50/30/20 for budgeting, often people formulate their Refund Ratio, how I would tell you to set up your ratio:

30% to reduce your debt

30 % for current needs (even emergencies)

30% towards your future

10% Treat Yourself

That sounds good, but like I called out about the budget in a ratio - you need to find out what ratio matches your reality. If you look at your money and see that you have different things you want to accomplish, you might want to adjust those ratios.

I wanted to add the 10% of the Treat Yourself or Blow Fund would be for you to buy yourself what you typically wouldn’t buy or look for. Some examples of this could be:

A Flower subscription

Massage Membership

A nice dinner (yes, you have food at home - but eat goodt)

Gift cards to treat yourself later. This could be like Target, Starbies, or your favorite place to stop. Why? So later when money is focused, you will have those gift cards to lean on versus blowing your budget.

Before Refund Check, Check -

Look at your current finances and money goals

The reason I want you to start here is that we can look at the check amount but not fully understand how it checks out in your finances. Yes, you have that money, but what do you want to get done?

How much debt do you have? Is there anything in the collections?

How much do you have in your emergency savings?

How are your bills looking? Are you ahead, on time, or behind?

What are your financial goals for this year? What’s that one big goal and a small goal that you want to knock off this year?

2. Do you know what credits that you would be getting back or any tax changes?

Talking with your tax preparer or CPA will give you an understanding of not only what you’re getting back, but if you’re getting your highest potential.

3. What else is going on with your money?

This is sort of what I mean when it comes to Auditing Your Wallet. You know what’s going on within your wallet before that windfall (Taxes, Bonus, New Job/More Pay, etc) comes into your account. No matter if you’re getting a tax advance or return, I want you to get the most out of your money.

Build Your Refund Ratio:

Now that we have an understanding of your money, I want you to understand what percent of your return or dollar amount will be going towards what. Here are some areas to build out your ratio:

Your Debt:

Your Savings:

PrePay Life/Bills:

*Blow Money/Treat Yourself:

Your Goals/Growth:

*Your Blow/ Treat Yourself typically should be looked at last because the other areas can give you ease more easily. I do want you to keep it a priority but think about positioning as well.

A starting 5 of how to divide your return to re-up or restructure your financial and actual house. Now that you determine what percent or dollar amount goes into your starting 5, let’s walk through how it looks in real life:

$400 into your HYSA/ High Yield Savings Account, in a year at 4% APY - your dollars could grow to around $420, but even more if you continue to add to it; this could be for your sinking funds, emergency fund or any goals you’re saving towards! Ally Bank has savings buckets and you know I love Marcus both as banking options for HYSAs.

$400 on that credit card with a balance of $800. This will help your credit and your credit utilization! Also making sure you’re getting the best APR you can right now - call and ask for a better rate if possible.

Get or renew your Term Life Insurance. Depending on how your policy is stacked up, the average Term policy is under $40. For those parents, think about getting your kids a Term Life Policy around this time, too!

$400 to pre-pay your variable bills like Electricity, Water, Gas, etc. Think of it like putting a “credit” to give you easy in case things get uneasy later on in the year. When a new bill comes, your “credit” or balance will pay your bill. Get a month ahead of your bills! I talked about doing this with the “pay up” strategy with Fast Company in this article talking about what to do with your tax refund.

$200 or so in gift cards to leverage throughout the year. You can buy gift cards to go out to eat or to shop at Sam's or BJ's. Speaking of those two, do you know that typically at the beginning of the year Groupon has deals on both Sam’s Club and BJ’s for cheap memberships? That $20 or so dollars could easily leverage you to stock up on things you need for your home - tissue, detergent, household goods, etc. Set a budget of $150 and go crazy getting your house in formation. Plus, don’t forget to get even more cashback by using Rakuten! I typically load up my Sephora gift card during this time for when the budget goes back focused!

Getting back a couple of stacks for your return? I mean, for 2023, taxpayers may be eligible for the child tax credit of up to $2,000 — and $1,600 of that may be refundable. $2000 of your return could pay your rent/mortgage payments for a month or so, depending on how much your rent/mortgage is. Or how many car payments could this return help you with?

You can put $400 on a secure credit card to not only build credit but to budget for anything that might come up. Think of it like another form of emergency fund.

$500 towards Christmas gifts (put it in that HYSA to let stack).

Add another contribution to your IRA (Roth or Traditional) and invest it into an ETF or Index Fund.

Open up an HSA with either Fidelity or B of A to help save for medical/wellness expenses during the year. You could also invest a portion of it later due to the fact they don’t expire.

Of course, set an amount to take yourself or your kids on a trip. It doesn’t have to be international, domestic still gives an experience. Also, you could get their passport or save for it. Use that tax credit to give them and the house a boost.

Another area is to think about growth - could you invest in a course, or memberships that could yield not only a return in your life now but could serve as a deduction for next tax season? Pay-up things at the top of the year could pay off for the rest of the year - plus you often get discounts for doing this.

To recap, after you figure out where you are financially by doing an Audit of Your Wallet and your financial goals, you could find your Refund Ratio that could be used towards:

Payoff high-interest debt

Save for your future

Protect your family

Get a month ahead of bills

Boost your education or skills

Make home improvements (boosting your home equity)

And so much more!

These are just some ideas, but think about where you currently are financially and break down into what categories you could build your life to be better by this time next year. Comment below to let me know what areas you are going to use your refund to re-up.

If you would like a 1-page plan on not only how to grow your refund but your overall financial planning, click here to learn more!

Here are some examples!